Quarterly Estimated Tax Payments 2024

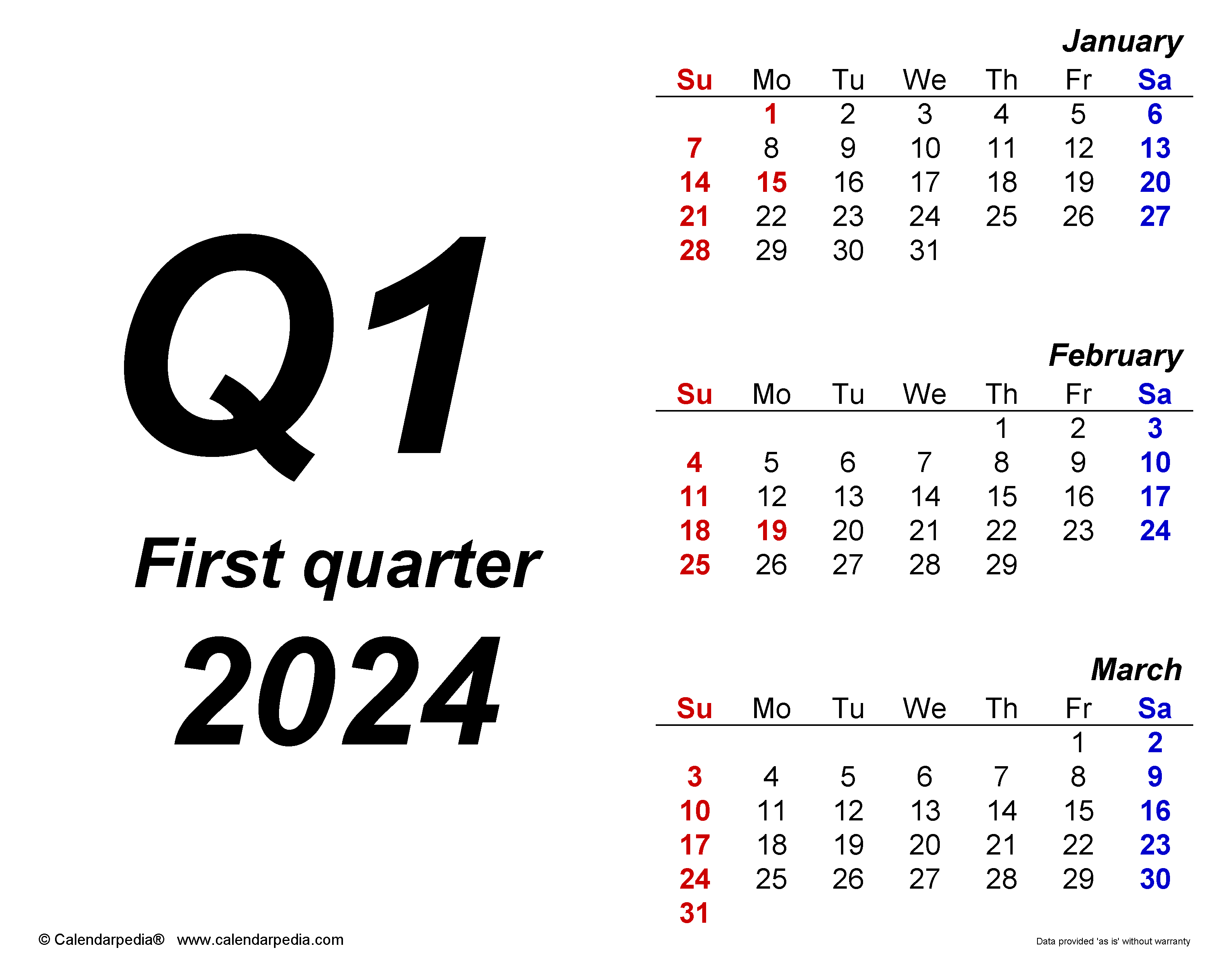

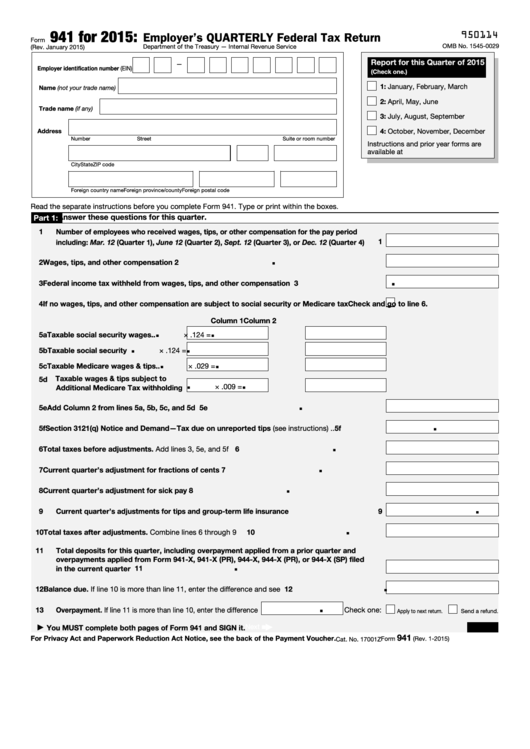

Quarterly Estimated Tax Payments 2024. When are estimated tax payments due in 2024? Tax payments an individual makes to the irs on a quarterly basis, based on estimates of what their total tax bill will be for the year.

Here is an overview of the quarterly estimated tax payment deadlines for 2024: Knowing these dates will help ensure that you pay your taxes on time and avoid any potential penalties.

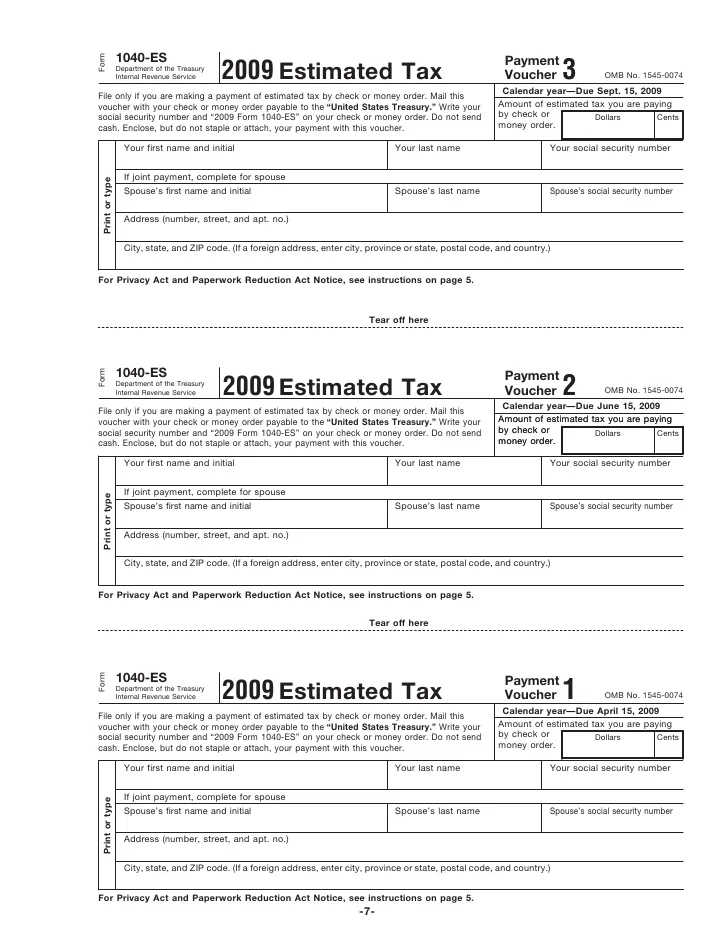

While the irs sets four main deadlines for estimated tax payments, you have the flexibility to make payments more frequently.

2024 Irs Quarterly Payment Dates Aurore Constantine, Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding. How to calculate estimated taxes.

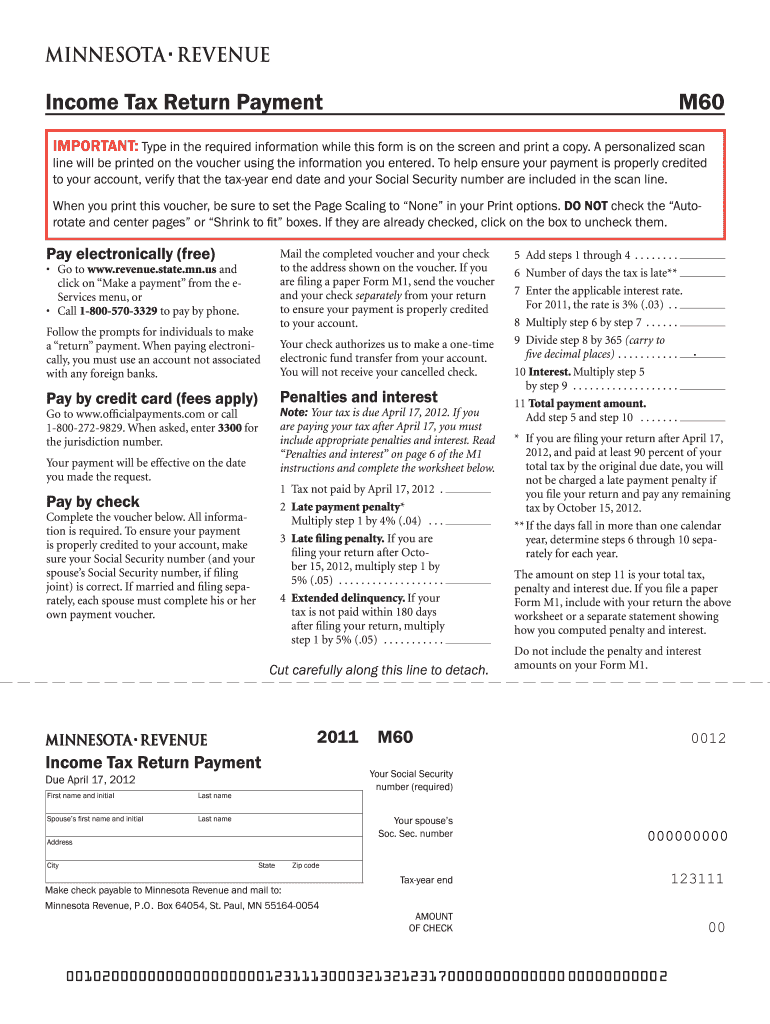

Irs Quarterly Tax Payment 2024 Karyl Dolores, Knowing these dates will help ensure that you pay your taxes on time and avoid any potential penalties. Second quarter estimated tax payment due;

Quarterly Estimated Tax Payments 2024 Due Ebonee Collete, View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Estimated quarterly tax payments are exactly what they sound like:

Irs Quarterly Payments 2024 Min Felecia, If you struggled with your estimated tax payments in 2023, this guide is for you. For example, if you worked in california all year, but are in the process of moving to arizona, your state input would be “california.”.

Pa Quarterly Tax Payments 2024 Sonni Elfrieda, Taxpayer z now has an estimated base income of $500,000 with an estimated tax payment liability of $42,750 ($500,000 x 0.095 (tax rate of 7% income tax + 2.5% replacement tax) x 0.9 (90% of this year’s tax liability)) for 2024. If you struggled with your estimated tax payments in 2023, this guide is for you.

2024 Estimated Tax Payment Forms Tiena Gertruda, The final payment is due january 2025. Not all freelancers and independent contractors actually have to pay quarterly.

2024 Quarterly Estimated Tax Due Dates Mirna Tamqrah, The final payment is due january 2025. Estimated quarterly tax payments are exactly what they sound like:

How Estimated Taxes Work, Safe Harbor Rule, and Due Dates (2024), This interview will help you determine if you’re required to make estimated tax payments for 2024 or if you meet an exception. For example, if you worked in california all year, but are in the process of moving to arizona, your state input would be “california.”.

Quarterly Tax Payments 2024 Forms Aurea Caressa, These changes include adjustments to the income tax slabs under the new tax regime, capital gains taxation, an increase in standard. Estimated tax payments are taxes paid to the irs throughout the year on earnings that are not subject to federal tax withholding.

Irs 2024 Estimated Tax Forms Dolly Gabrila, Quarterly estimated tax payments for the 2024 tax year are due april 15, june 17, and september 16. Quarterly payroll and excise tax returns normally due on july 31 and oct.

View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments.